Protecting your rights and pursuing your goals

In the pursuit of justice, we stand as a shield for the powerless, a voice for the downtrodden, and a beacon of hope for those in need

Make an appointment

What makes us different makes us better.

Experience our exceptional legal services - personal, expert and results-driven. Whether you need assistance with litigation, corporate law, or any other legal matter, count on our expertise to protect your rights and achieve the best results.

Explore our services

About

Our Success

Our success is a testament to our unwavering commitment to our clients and our relentless pursuit of excellence in the field of law.

Years Experience

0

+

Global Customers

+

0

k

Professional Attorneys

0

+

Our Expertises

The lawyer you choose will make a difference

The choice of your lawyer can be the pivotal factor that determines the outcome of your legal matters. It’s a decision that can shape the trajectory of your case, affecting your rights, interests, and ultimately, your future.

Call for a Consultant

Insurance

Authentication

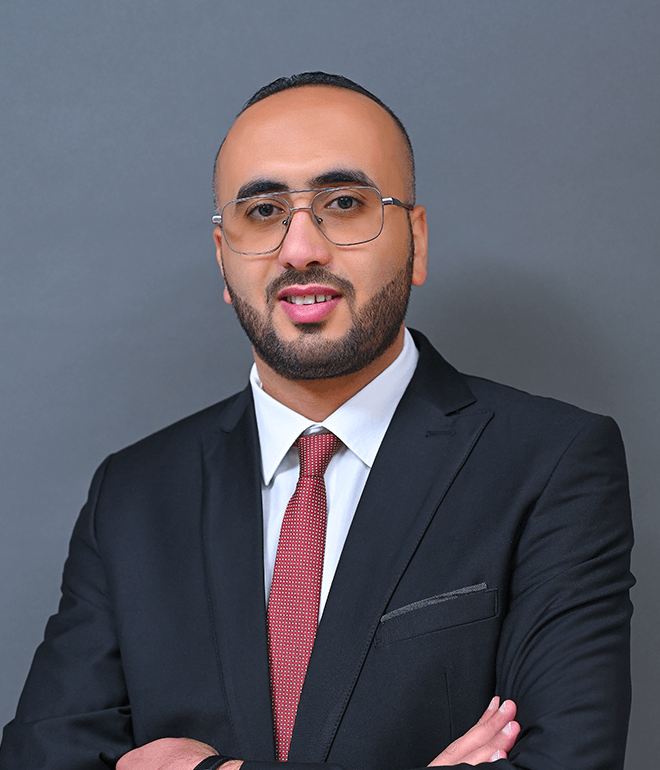

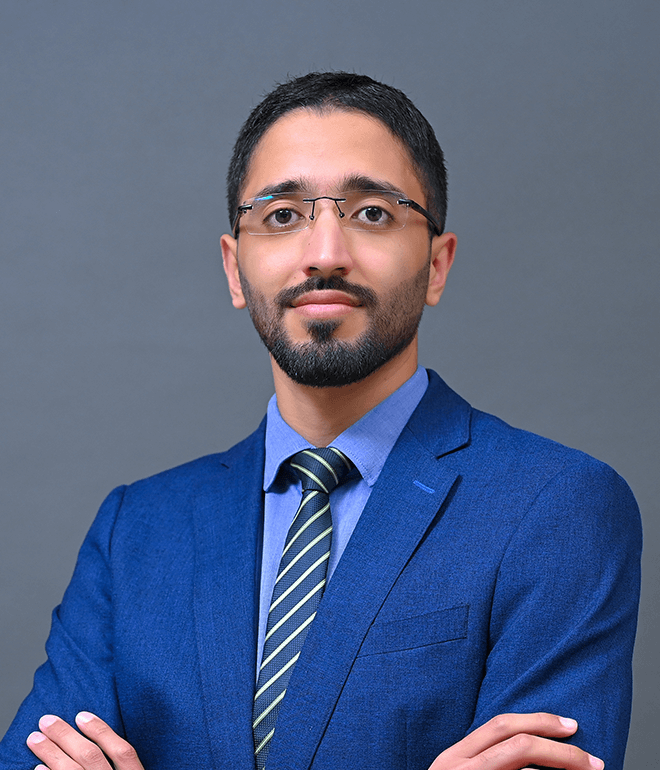

Attorneys

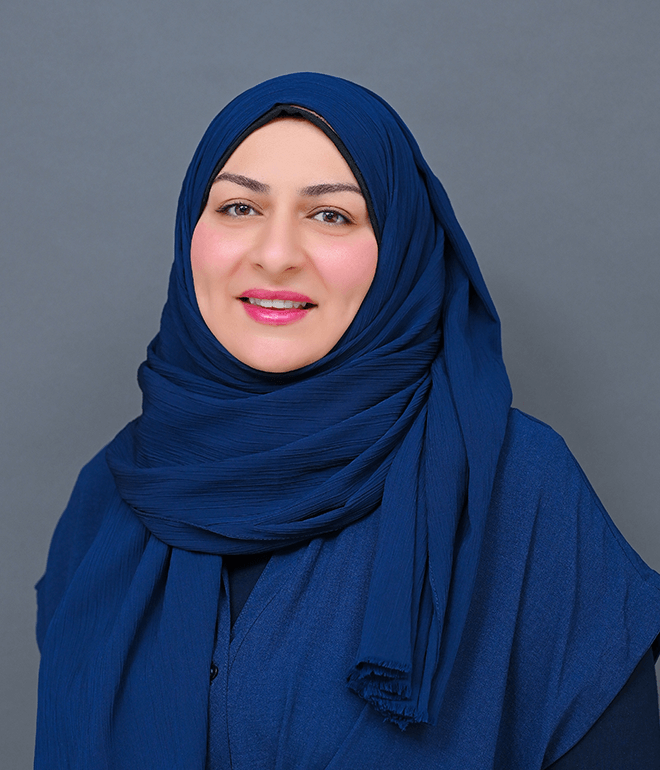

Meet Our Team

Meet our exceptional team of legal professionals, the cornerstone of our firm's success.

Testimonials

Trusted by

Our Customers

From the reality of my dealings with the office, lawyers and consultants with the highest efficiency in terms of dealing and experience, and it is considered the best law firm ever from the actual outcome of the cases entrusted to it.

Osama Elsheikh

Google ReviewsOne of the best law firms, with credibility in dealing, speed in completion, and respect

Shadi Azzam

Google ReviewsA distinguished office managed by Mrs. Abeer, speedy completion and accuracy in work

خالد المعمري

Google ReviewsOur Partners

We take pride in building lasting relationships with our clients, earning their trust through transparency, diligence, and unwavering commitment.

Abeer Al Dahmani’s law firm is dedicated to upholding professional values that prioritize clients’ best interests and maintain the integrity of the legal profession.

Links

Practice Areas

Developed by Pixoo Media